Costs of credit card fraud in the U.S. alone are estimated at $8.6 billion per year. One of the ways to combat this problem is through EMV security technologies. EMV chip cards are being added to the arsenal of weapons calculated to help secure the U.S. payments infrastructure. The added protection is important because by October 2015, major networks will shift fraud liability to either the issuer or the merchant, depending on which has the least secure technology. October 2015 is the date that card issuers such as American Express, Discover, MasterCard and Visa are required to update to EMV chip cards, terminals and processing systems.

Key Features

EMV chip technology was developed jointly by Europay, MasterCard and Visa in 1994, to create a global chip specification payment system and prevent financial fraud. The key features of the chip in credit cards are that they store information, perform processing, are a secure element which stores secrets and performs cryptographic functions. They protect against counterfeit fraud through authentication of the chip card and smart phone. They validate the integrity of the transaction through digitally signing payment data.

EMV chip technology is an extremely effective method of reducing counterfeit and lost/stolen card fraud in a face to face payments environment. That is why the PCI Security Standards Council supports the deployment of EMV. EMV chip cards, have advantages over traditional magnetic stripes. The chip’s security code changes with every purchase and the card is much less vulnerable to counterfeiting, experts say. The chip can not be duplicated.

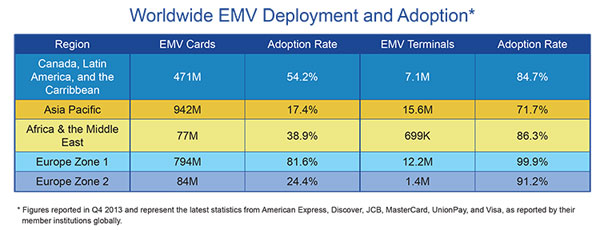

Worldwide Adoption

EMV technology will reduce the chances for fraud, but the evolution to the new technology will take some time. Merchants will have to change equipment to read the chip’s security code. Magnetic stripes won’t disappear overnight. During the transition, cards will still be vulnerable to counterfeiting.

In early June, Sam’s Club introduced a rewards credit card using the chip. Sam’s parent company, Walmart, will follow suit later this year. Target, which was the victim of a huge security breach recently, has opted to add chip-and-PIN technology to its store-branded cards early next year.

The shift to EMV is part of a systematic upgrade of payment security that is being developed to counteract weaknesses that lead to security breaches. Among the budding technologies is “tokenization,” which would substitute a meaningless string of alphanumeric characters and biometrics for current credit card credentials. Anything that will stymie hackers in their pursuit of other people’s personal information is likely to be scrutinized.

Data Breaches

A large-scale data breach, such as those the country has experienced in recent months, could still affect your card, industry leaders say. If Target, for instance, had been already using the chip technology before its system was breached, it would not have protected the company from hackers who infiltrated the company’s database through a third party access credentials. That gave the hackers information on cardholder account numbers and personal information, such as names, addresses and phone numbers that greatly increased the scope for identity theft.

Best Practices

Until the problems of protecting ID are resolved, take a proactive stance. Protect your card against fraud or data breach, as much as possible. Use unique and more sophisticated passwords for online accounts, monitor your bank statements and sign up for available alerts. Report immediately to your financial institution if your card is lost, stolen or compromised so it can be replaced with a new number as quickly as possible. That will save you the hassle of disputing unauthorized charges