Bank Of America Employee Found Dead

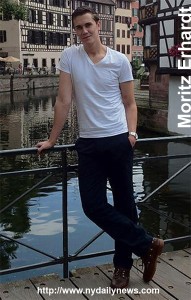

Entrance into the competitive financial job market is sometimes accomplished through internships. Recently Moritz Erhardt, an intern for Bank of America in their City of London offices was found dead in his apartment.

Erhardt was employed in the firm’s investment-bank division, in a 7 week internship contract. Erhardt’s salary during this time was forty-two hundred dollars a month.

Friends of Erhnardt’s reported that he been forced to work through the night eight times in a two week period in an effort to secure long term work with the firm. It seems that Erhardt was personally driven to be the best in many areas of his life, a habit that started in elementary school. He was always in over-drive to perform well.

He had recently worked through several nights and had not slept for 72 hours. The intern had an epileptic condition which also added to the tragedy.

So there are several motivating factors that push people to work beyond their limits. A strong desire to accomplish something for themselves or for their companies can push people past their reasonable points. Another desire is to advance their careers to assure high salaries in the finance industry.

What ever the reasons people have for over working, it is the employers who need to be aware of how intensely their employees are driven and try to put limits in place to help them stay reasonable. One might wonder if a workplace culture that acknowledged workers’ needs as much as employers’ bottom lines might have helped prevent the tragedy of Erhardt’s death.

Bank of America is looking into the causes of his death as well as looking at what they can do to change employee working conditions. Nothing is as important as assuring good working conditions and reasonable work expectations in the corporate world. This tragedy is heart breaking for many and can serve as a stepping stone to change policies to prevent this from happening again.

We want to offer condolences to the family in this sad time of loss.

Preventing Tragedies Like This

Be sure to take care of yourself if you know you are putting in too many hours. Keep life activities in balance by saving time for enjoying life with family and friends. Get required sleep and eat a healthy diet. Without those basics, life can get scarey and have bad outcomes.