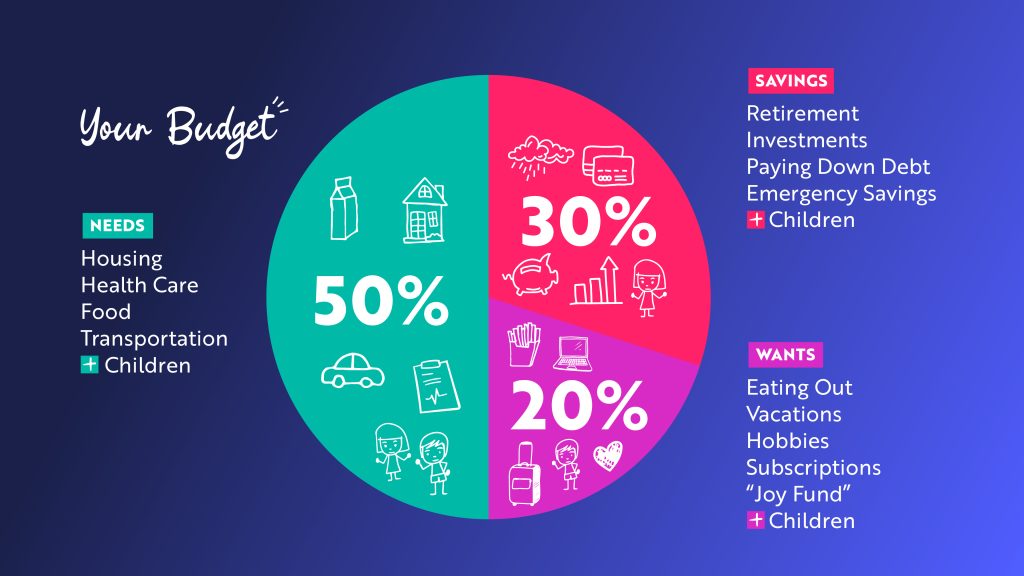

Managing personal finances can be challenging and heartbreaking, however using one simple and effective budgeting method, the 50/30/20 rule. This rule helps individuals allocate their income efficiently, ensuring they cover necessities, enjoy some discretionary spending, and save for the future.

The 50/30/20 Rule Offers A Life Long Money Management Plan

50% for Needs: This portion covers essential expenses that are necessary for living, such as:

- Rent or mortgage payments

- Utilities (electricity, water, internet)

- Groceries

- Insurance (health, car, home, etc.)

- Minimum debt payments (student loans, credit cards, etc.)

- Transportation costs (car payments, gas, public transit)

30% for Wants: This category is for non-essential but enjoyable expenses, such as:

- Dining out and entertainment

- Subscriptions (streaming services, magazines, etc.)

- Hobbies and leisure activities

- Travel and vacations

- Upgraded gadgets or accessories

20% for Savings and Debt Repayment: This portion is dedicated to securing financial stability and planning for the future:

- Emergency fund contributions

- Retirement savings (401(k), IRA, or other plans)

- Additional debt payments beyond the minimum

- Investments (stocks, bonds, real estate, etc.)

Personal Finance Budgeting

- Simple and Easy to Follow: Unlike complex budgeting methods, this rule is straightforward, making it accessible to beginners.

- Encourages Responsible Spending: It ensures essential needs are met first before discretionary spending occurs.

- Promotes Savings and Financial Security: By allocating 20% toward savings and debt repayment, individuals build a financial cushion for emergencies and future goals.

- Flexible Yet Structured: The rule provides a guideline while allowing flexibility to adjust spending within categories.

- Reduces Financial Stress: Having a clear financial plan reduces uncertainty and helps individuals stay in control of their money.

Tips To Personal Finance Success

- Track expenses for a month to understand current spending habits.

- Adjust budget categories based on personal financial goals.

- Automate savings contributions to ensure consistency.

- Reassess and adjust as needed for changes in income or expenses.

By following the 50/30/20 rule, individuals can develop healthier financial habits, avoid unnecessary debt, and work toward long-term financial success. Whether you are new to budgeting or looking for a simpler way to manage your income, this method provides a reliable foundation for financial stability and growth.

Helpful Reading About Money Management Plans

The 50/30/20 Budget Rule Explained With Examples

August 21, 2024 — The 50/30/20 budget rule is a simple and effective plan for personal money management and wealth creation. It balances paying for necessities with saving and investing.A reputable source that delves deeper into the 50/30/20 budgeting rule is Investopedia’s article, This resource provides detailed insights and practical examples to help readers understand and implement this budgeting method effectively

Americans Are Spending Beyond Their Means.

October 10, 2024 — What Is the 50-30-20 Rule? This budgeting rule suggests that working adults allocate 50% of their income to needs, 30% to wants, and 20% to save for retirement and other goals.

What Is The 50/30/20 Rule?

This article from Forbes Advisor provides an in-depth explanation of the 50/30/20 budgeting rule, including its benefits and potential drawbacks.This resource should offer valuable insights into applying the 50/30/20 rule to your personal finances.

Personal Financial Inspirational Message

Focusing on long-term financial goals isn’t just about money—it’s about freedom, security, and building the life you truly want. Imagine waking up one day without worrying about debt, knowing your savings can handle any emergency, and having the resources to enjoy life on your terms. Every dollar you save and invest today is a step toward that future. Stay patient, stay consistent, and trust the process. The sacrifices you make now—spending wisely, budgeting smartly—will pay off in ways you never imagined. Your future self will thank you for every smart decision you make today. Start now—your dreams are worth it!