It just seems to make sense that if you keep plugging along at a your job, by the time you retire you should have come closer to the level of wealth some others enjoy.

Not so, experts in the field say. Thousands of Americans struggle to set aside enough money to enjoy retirement, particularly those who are self-employed. They are having little success at building an adequate post-employment reserve.

The challenge is so overwhelming that many refuse even to look it square in the eye, which becomes a serious part of the problem. Pensions that used to provide the safety net for many workers are becoming rarer in the private sector and workers at the low end of the totem pole often have no access to such programs.

All of this contributes to the widening gap between the average worker and the wealthy. With more than 70 million Baby Boomers preparing to leave active employment and settle into retirement, that is not good news. The net result may be government services stretched more thinly and more elderly people staying in the working ranks for longer, increasing the challenges for younger workers looking for jobs.

Who Fares The Best In Retirement?

Predictably, next to the really wealthy, those who fare best in the retirement picture are highly educated couples. They are likely to have more resources such as 401k plans, savings and home equity that are a boon when their jobs end. Those with less education, health issues and/or lower income and fewer resources can only watch in frustration as their prospects for a financially secure retirement fade into the distance.

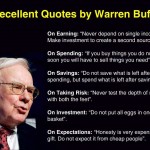

The old saying that the rich get richer while the poor get poorer is literally true in today’s economy. Incomes for the top 1 percent of earners rose 31 percent from 2009 to 2012, according to an economist at the University of California/Berkeley. For the remaining 99 percent, the rise averaged 0.4 percent.

In households with annual income under $25,000, nine of 10 had savings under $10,000, according to the Employment Benefit Research Institute. For households in which earnings topped six figures, 42 percent had savings of at least $250,000, the institute reported. Five years ago, that percentage was 34 percent, another indication that the retirement prospects for those in the low-earnings categories are making no headway toward any kind of parity.