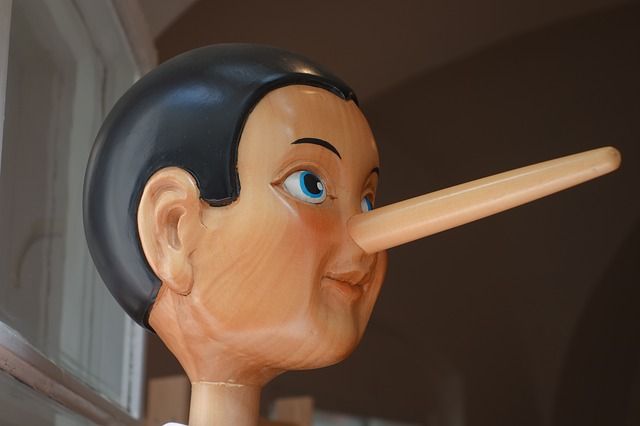

Managing money is one of the top concerns couples list when they talk about problem areas. Throw in a situation in which one – or both – of the partners are not truthful about money matters, and you have the makings of marital disaster.

The lies can be about any aspect of the couples’ money management, but often include hiding spending on unplanned shopping, gambling or taking on additional debt without consulting the partner. It’s the cause of a lot of anguish in many marriages. Some experts go so far as to call it a form of infidelity.

If you suspect that your spouse is failing to tell the whole truth about finances, what do you do? Before confronting the spouse, experts advise, find out as much as you can about your current financial condition. Check bank statements over the past year to see if the untruths have been going on for an extended period. Try to have specific examples of the issues you want to discuss.

It is possible that your assumptions are not correct. Discuss your concerns in a calm way and listen to what the offending spouse has to say. It is possible that lies about money are related to other problems, such as shopping addictions, gambling or possible criminal behavior. You may find that as a couple you have more debt issues than you supposed.

Could be that the problems are so serious that you consider them a deal breaker. The answer is particular to the two persons involved. Whenever there is a breach of trust, healing may take a long time. If the offending partner is not willing to address underlying issues and make a real effort to change things, it may be hard to move forward.

If you choose to remain together, make definite plans for handling your money. Considering separating your accounts with each taking responsibility for certain expenditures. Or let the responsible partner have control until trust has been re-established.

A budget is the easiest way to account for money. In most cases, each partner would be expected to make the same contribution toward shared expenses. The person who has lied about money issues should be willing to share records that account for his or her money handling.

Seeking counseling may be necessary if there is evidence of an addiction related to money. Such addictions are as real as those related to drugs or alcohol.

If the marriage is to be salvaged, there must come a time to forgive and forget the issues so that you can move beyond them. That may take some time.