The Right Questions

How does a business owner know if they have asked themselves the “right questions” to start a business or make their business grow? To answer that question, let’s take a look at some successful businesses.

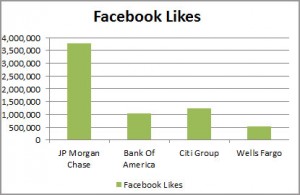

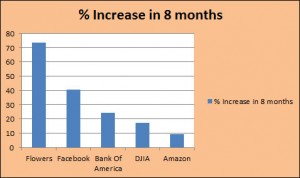

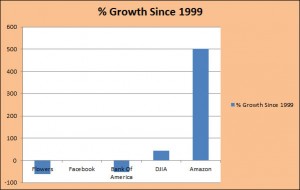

Facebook, Amazon, Bank of America and 1-800-flowers.com are recognizable companies to most people. People are also familiar with the DJIA, Dow Jones Industrial Average. Whether you own stocks in any of these companies or not, they command attention even from you. We have examined company growth of their stock prices for the last eight months for Facebook, Amazon, 1-800flowers, Bank of America and the DJIA. Results from this data show that In the last eight months, there has been considerable growth in Flowers and Facebook. You can also see that the biggest improvement during this time period is at 1800flowers.com.

What is the bigger question you need answers to?

So What Questions Do You Ask?

Sometimes business owners ask themselves the wrong questions and focus on the wrong areas. What questions can you ask yourself that will help take your business to it’s next growth spurt? Not sure what to ask?

Here are five questions you may want to think about.

1. If you are buying a previously owned business do you know all the details of what made it work?

2. If you are creating a new product, have you Provisional Patent Application to protect your idea from being copied for up to a year?

3. Do I have the best suppliers for my niche? Thomas Register of Manufacturers, offers the largest directory of direct industrial suppliers, while your local library has listings of manufacturers listed by state.

4. What does my competition look like? Research online and offline.

5. What is my market potential?

There are many questions that businesses need answers to. Make sure you have asked the most relevant questions for your particular business.

What questions do you ask yourself about your business?