Forbes Magazine winnowed down the list to share with readers. Their pool of gurus includes five billionaires, a miser, a Nobel laureate, a founding father and assorted and sundry people whose names rise to the top whenever success is the topic.

Examples include:

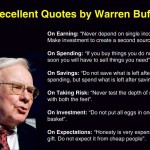

Warren Buffet, whose $65 billion empire was built on buying businesses that he was certain were worth more than the sellers envisioned: “Whether socks or stocks, I like buying quality merchandise when it is marked down.”

Sir John Templeton, founder of Templeton Funds, who made a killing by defying the conventional wisdom about the stock market, buying when others were selling: “If you buy the same securities everyone else is buying, you will have the same results as everyone else. . . Buy at the point of maximum pessimism, sell at the point of maximum optimism.”

Nathan Mayer Rothschild, 1776-1836, founder of N. M. Rothschild & Sons. “Information is money.” Thanks to his extensive network of carrier pigeons, and the careful placing of his sons in strategic European cities, Rothschild knew that England had defeated France in the Battle of Waterloo before anyone else in London. As other traders on the stock exchange braced for a British loss, he capitalized on his early information to build a fortune.

Peter Lynch, manager, Fidelity Magellan Fund. “Buy what you know.” He applied his knowledge of wise money management to generate an annual return of 29 percent. His secret to profitable investing: Don’t buy Twitter or Amazon, but do buy those suggested by A.All .com and Validea.com, NetApp, Barrett Business Services, Honda, Publis and Alliance Fiber Optic.

Alexander Hamilton, first U.S. Secretary of the Treasury, who earned the nickname Little Lion. His bestseller: the $10 bill. During the country’s formative years, he tirelessly advocated for responsible federal finances. His lesson: Don’t buy securities in developing countries with dodgy rulers. “A nation which can prefer disgrace to danger is prepared for a master and deserves one.”

David Tepper, founder Appaloosa Management. During the panic of early 2009, he bet heavily on Bank of America, Citigroup and AIG. Quit Goldman Sachs in 1992 to build his own hedge fund. Reputation for clearheaded moves in environments of fear and misinformation. His quote: “I am the animal at the head of the pack. I either get eaten or I get the good grass.” He advises paying careful heed to central bankers and fiscal policymakers.

Hetty Green, 1834-1916: Description, miser; nicknamed “The Witch of Wall Street.” She inherited $5 million at age 30 and had multiplied it into $100 million by the time she died in 1916 by ferreting out investments that would earn her 6 percent annually, doubling her fortune every 12 years. The richest woman in the United States, she saved pennies by refusing to use hot water, wash her clothes or provide her son with decent medical care. “All you have to do is buy cheap and sell dear, act with thrift and shrewdness and be persistent.”